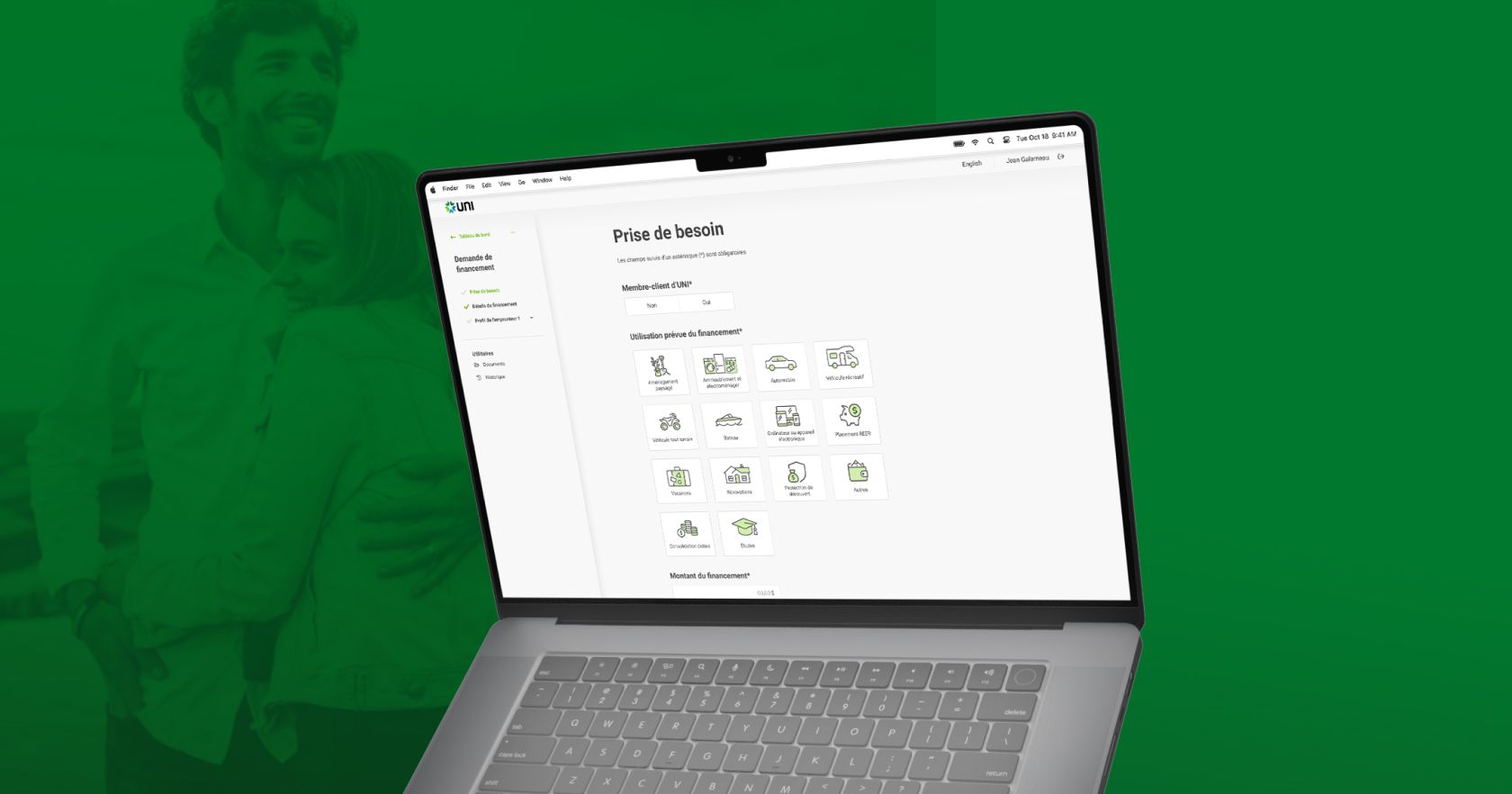

After developing the financial institution’s vehicle loan application management software in record time, Nmédia was entrusted with a new mission: creating a fully online personal finance application platform.

Building on the foundations and work already accomplished for the Marguerite project, Nmédia supported UNI in developing this new online personal loan product for its customers. Numerous meetings and workshops with UNI teams enabled Nmédia developers to fully understand UNI’s workflow and requirements for designing such a platform, which will be codenamed “Princesse”.

An autonomous, accessible Web platform

Because it is 100% virtual and autonomous, particular emphasis has been placed on the user experience (UX) so that financial institution customers can easily fill in all the fields required to submit their loan applications. Financial advisors will also have access to a dedicated portal to track the progress of tasks and applications.

Certain functionalities have been implemented in the tool to guarantee the autonomy and viability of the online product, such as electronic signature and identity verification. The objective for the Nmédia teams was to reproduce the business processes of branch agents in an autonomous web platform without intermediaries. To this end, functionalities such as automatic document generation with signature locations, document return management and insurance calculation were implemented.

The Princesse project is perfectly functional, fulfilling its primary mission of providing loan applicants with an autonomous web platform for their submissions.